| Announced | 1st August 2015 |

| Objective | Social Alleviation and Financial Security |

| Administered by | Government of India |

| Current Status | Active |

Pradhan Mantri Suraksha Bandhan yojana is a kind of fixed deposit scheme. Which you can purchase from all nationalized bank, this scheme offers interest rate of 8 percent on fixed deposit which is little higher in comparison to any other fixed deposit scheme available in market.

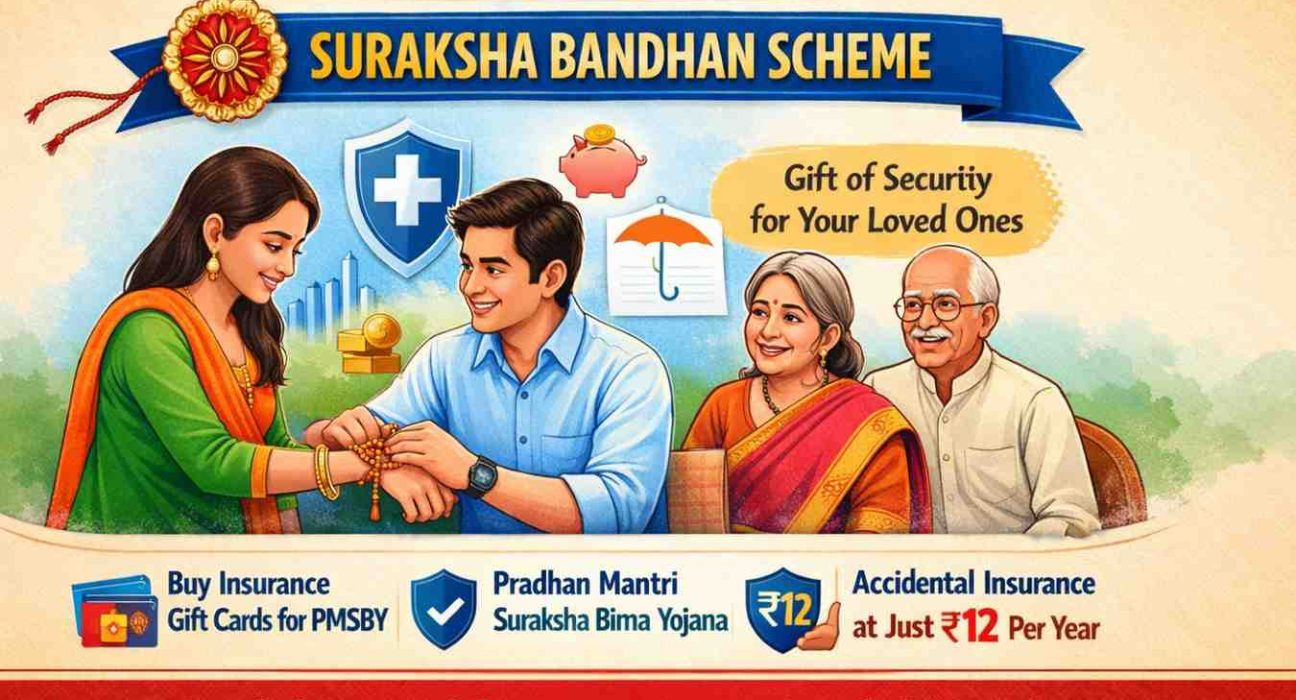

PM Suraksha Bandhan Scheme can be used as gifting which is always on high demand in India. You can buy it for your sister and daughter so that they can use it in future or whenever they needed.

This scheme is launched and operate by Government of India and anyone can avail the facility under this scheme

This scheme is available in 3 different formats :

- Jeevan Suraksha Gift Cheques (Rs. 351)

- the Suraksha Deposit Scheme (Rs. 201)

- Jeevan Suraksha Deposit Scheme (Rs. 5001)

Features and Benefits of Pradhan Mantri Suraksha Bandhan Yojana/Scheme :

- Fixed Deposit falls under this scheme would be avail in the form of Gift Card or Banker’s Cheque, which you can gift to your loved one on any occasion

- Gift card of this scheme would carry a fixed value of Rs.201, Rs.351 and Rs.5001

- You can also attached the gift card of this scheme with other pradhan mantri schemes like Pradhan Mantri Suraksha Bima yojana or Pradhan Mantri jeevan jyoti bima yojana etc.

- Balance amount on your gift card would be deposited as fixed deposit and would earn a interest rate of 8 percent

- You can also deposit these gift on your saving bank account and enjoy the handsome interest rate.

Tax benefit on Pradhan Mantri Suraksha Bandhan Yojana

- It is a noble scheme, and there are little limitation of this scheme. This scheme is termed as Fixed Deposit, but this is also not the complete fixed deposit scheme as small amount of it go as a premium for scheme covered under this yojana.

- Second limitation of this scheme is that Fixed Deposits are taxable as we already know, so all investment made under this scheme would also be taxable. This can be a reason to restrict lot of people to purchase it.

Jeevan Suraksha Gift Cheque (Rs. 351/-)

The gifter will purchase gift instrument of Rs. 351/- out of which DD will be issued for Rs. 342 and Rs. 9/- will be collected as DD charges. The giftee will then deposit DD of Rs. 342/- in his/her account. Illustration is as under:

| Total Amount to be collected | One year Premium of PMSBY | One Year Premium of PMJJBY | Total (DD Amount) | DD Charges |

| Rs. 351 | Rs. 12 | Rs. 330 | Rs. 342 | Rs. 9 |

Suraksha Deposit Scheme (Rs. 201/-)

Cash/Cheque can be deposited into the existing SB Account or newly opened SB Account. The appropriation of Rs. 201/- will be towards PMSBY. Illustration is as under:

| Total Amount to be Deposited | 1st year Premium | 2nd Year Premium | Total Amount of TD (5 Years) | Indicative Returns# @8%* p.a. |

| Rs. 201 | Rs. 12 | Rs. 12 | Rs. 177 | Rs. 14.16 |

#Premium from 3rd year onwards will be recovered from interest payout in SB Account

Jeevan Suraksha Deposit Scheme (Rs. 5001/-)

Cash/Cheque can be deposited into the existing SB Account or newly opened SB Account. The appropriation of Rs. 5001/- will be towards PMSBY and PMJJBY. Illustration is as under:

| Total Amount to be Deposited | 1st year Premium | 2nd Year Premium | Total Amount of TD (5 Years) | Indicative Returns# @8%* p.a. |

| Rs. 5001 | Rs. 12 + 330 | Rs. 12 + 330 | Rs. 4317 | Rs. 345.36 |

#Premium from 3rd year onwards will be recovered from interest payout in SB Account